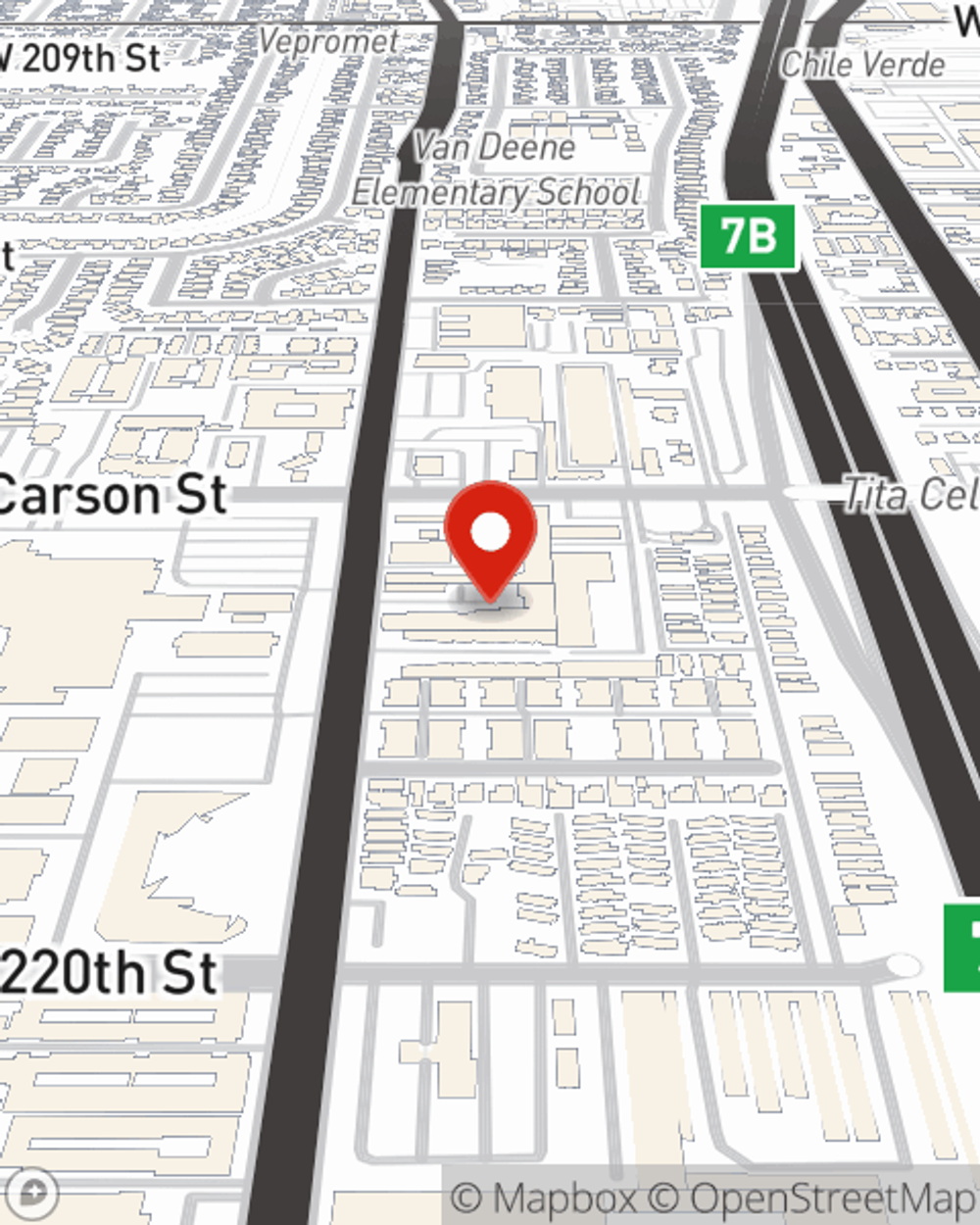

Renters Insurance in and around Torrance

Renters of Torrance, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

No matter what you're considering as you rent a home - price, utilities, number of bedrooms, house or townhome - getting the right insurance can be important in the event of the unexpected.

Renters of Torrance, State Farm can cover you

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

When the unanticipated accident happens to your rented condo or apartment, often it affects your personal belongings, such as a tool set, a stereo or an entertainment system. That's where your renters insurance comes in. State Farm agent Michelle Gibson is committed to helping you choose the right policy so that you can protect yourself from the unexpected.

Renters of Torrance, State Farm is here for all your insurance needs. Call or email agent Michelle Gibson's office to get started on choosing the right policy for your rented apartment.

Have More Questions About Renters Insurance?

Call Michelle at (310) 328-3359 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Michelle Gibson

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.